For startups, knowing what is cash raised vs post money is key to getting funding and growing. Cash raised vs post money explained is more than just words. It shows a company’s financial health at important times. Cash raised is the money from investors, while post-money valuation includes this money and shows the company’s worth to investors and founders.

For more on these important ideas, check out Investopedia. They offer a detailed look at these startup financing definitions. Knowing the difference helps everyone make smart choices that protect their money and goals.

Key Takeaways

- Understanding the differences between cash raised and post-money valuation is key for company value during funding.

- Post-money valuation is found by adding funds raised to pre-money valuation, affecting who owns what.

- Terms like ‘up round’ or ‘down round’ show if a company’s value goes up or down after funding, affecting investor views.

- Preferred shares and VC investments can protect early investors from losing value.

- It’s important to know how ownership changes after funding, especially in cases where founders’ shares decrease even if their value stays the same.

- How a company is valued during funding rounds is crucial, with methods like DCF and Comparables being common.

Defining the Financial Landscape: Cash Raised and Post Money Valuation

Understanding corporate finance, especially for startups, means knowing about cash raised definition and post-money valuation clarification. Startups need funding to grow, and these metrics show the company’s value before and after investments. This section aims to explain these key points for new businesses and investors.

Cash Raised Definition

“Cash raised” is the total money a company gets from investors, not counting later financial moves. It shows how much money a startup has to start or grow its business. Understanding cash raised helps see how much money a startup has before it takes on more debt or financial perks.

Post Money Valuation Clarification

Post-money valuation shows a company’s worth after new money comes in. It’s important for knowing the company’s updated value and how much new investors will own. With this post-money clarification, everyone can plan better about who owns what and future funding.

For example, if a company’s value goes from $7.5 million to $10 million after an investment, it shows the value increase. This also makes managing who owns what more complex, especially with special financial tools that can change the ownership picture.

Knowing about cash raised definition and post-money valuation clarification is crucial for those involved in startup financing. As companies grow, understanding these figures is key for making smart decisions and ensuring everyone knows the financial stakes.

The rise in venture capital funding, growing by about 15% each year, highlights the importance of these valuations. They change over time, reflecting the market’s shifts and investment trends.

So, moving from understanding cash raised to grasping post-money implications is key for financial management in startups. It helps ventures not just survive but also grow in a competitive world.

Timing is Key: Understanding Pre-Money and Post-Money Differences

Startup funding is complex, especially when looking at pre-money valuation concept and post-money valuation. These valuations are key in the talks between founders and investors. They shape the startup’s growth path.

Pre-money valuation is the startup’s value before any money is put in. It looks at the business model, market, and current operations. This sets the stage for talks.

Post-money valuation adds the new money to the pre-money value. It shows the startup’s new worth after the investment.

The importance of cash raised and post money is huge. Founders want a good post-money valuation to keep their share big. Investors look at this value to see if the business will grow.

- Understanding these valuations helps both sides agree on terms that fit their goals and plans.

- The difference between cash raised and post money changes who has control in the company. The cash raised affects the post-money valuation, deciding how much equity goes to whom.

For example, a startup with lots of investor interest starts with a key pre-money valuation. This value is crucial for talks. A higher pre-money valuation means investors give up less equity for the same money.

But, more cash raised usually means a higher post-money valuation. This changes the company’s equity picture.

To succeed, both sides need to understand pre-money valuation concept and post money valuation. They must balance this with the cash raised. This balance is key to a good deal for everyone involved.

The Critical Role of Valuation in Funding Rounds

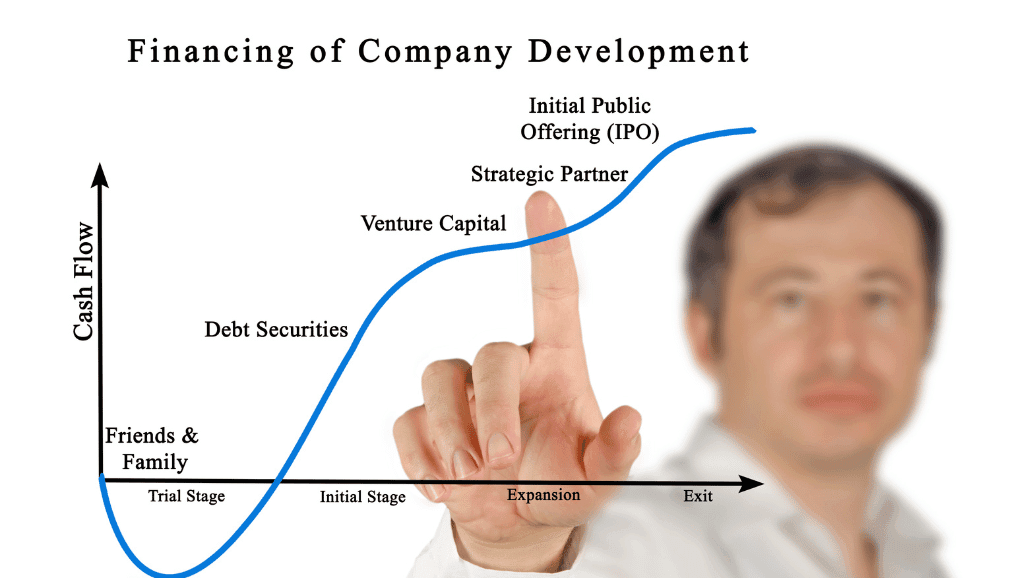

In the world of startup investment, knowing how to value a company is key, especially when getting venture capital financing. Valuation is a key number that helps investors decide to invest and shows how healthy a startup is financially. It also shows where the startup stands in the market.

Valuations change based on many things like the financial state of the sector, competition, and how fast a startup is growing. For example, quick commerce companies are often valued at about 2X their revenue. This shows how certain sectors can affect how much a company is worth.

- Pre-money and Post-money Valuations: Knowing a company’s worth before new money comes in is important. This is called pre-money valuation. Post-money valuation adds the new money to the pre-money value. It helps figure out how much of the company new investors will own.

- Calculation Methods: To get a good valuation, people use things like Market Multiples, Discounted Cash Flow (DCF), and Asset-Based models. These methods make sure the valuation fits with what investors expect and what the industry standard is.

- Impact on Equity Distribution: The post-money valuation is very important. It decides how much of the company each shareholder owns. This affects how money is split in future funding terms explained.

Valuations also affect big decisions. For example, they help figure out how much of the company new investors will own. A clear valuation agreed by all means everyone knows their share. This is important for good relationships between investors and founders.

As a startup grows, these valuations help check how it’s doing and plan for the future. They help with both looking at the present and planning for the future. They are key for growing and getting more venture capital financing.

In short, understanding valuation in startup investment is not just important. It’s crucial for a startup’s growth and its relationship with investors.

What is Cash Raised vs Post Money: Identifying the Distinctions

Understanding the cash raised vs post money difference is key in startup finance. It shows how much money a startup has and its value after getting that money. This knowledge helps in making smart investment choices.

Components of Cash Raised

‘Cash raised’ is the money startups get from investors, venture capital, and more. It’s important because it helps the company grow without worrying about its value changing.

The Essence of Post Money Valuation

‘Post money valuation’ shows a company’s value after getting new money. It’s found by adding the company’s old value to the new money. Investors look at this to see how much they might own and the company’s future.

Talking about differentiating cash raised and post money is important. It helps plan for future funding and value assessments. This is crucial for making smart decisions.

Both metrics are vital in investment talks. They help decide on equity, value, and future funding plans. Knowing them well is important for all involved.

Understanding these basics helps everyone in finance make better choices. Knowing the cash raised vs post money difference makes finance easier. It also guides the growth of new businesses.

Startup Investment Terminology: Navigating Cash Infusions and Valuations

In the world of startup funding, knowing key financial terms is crucial. This part explores cash infusion interpretation and post-money evaluation explained. It shows how these factors shape a startup’s path.

Interpreting Cash Infusions in Financing

In 2023, the startup world saw a big trend in Simple Agreements for Future Equity (SAFEs). 89% of pre-seed funding rounds chose SAFEs. They are popular for their flexibility and ability to add cash without immediate equity loss.

Knowing this startup funding term helps understand how company value grows after funding. This is key for planning and growing operations.

Decoding Post-Money Valuation in Startup Investments

The post-money evaluation explained shows a company’s worth after funding. It combines the value of cash added. For example, if a startup has a pre-money valuation of $15 million and gets a $1 million investment, its post-money valuation jumps to $16 million.

This increase shows investor confidence and market potential. It’s a key metric for tracking growth and setting funding goals.

Understanding terms like cash infusion interpretation and post-money evaluation is vital. Whether through equity or convertible notes, each investment must be evaluated carefully. This ensures accurate predictions of future financial health and investor returns.

Calculating Cash Raised and Post Money: A Guide for Entrepreneurs

Securing funding is a complex journey for entrepreneurs. They must grasp pre-money and post-money valuations. These figures are key to planning future financing and seeing how investments affect the business.

Step-by-Step Calculation of Post-Money Valuation

Knowing about post-money valuation is crucial for entrepreneurs looking to raise funds. It shows a company’s worth after new investment. For example, ABC Tech, valued at $10 million before, becomes worth $12 million after a $2 million investment.

Calculating post-money financing involves adding the investment to the pre-money value. Also, convertible notes or SAFEs must be included in the valuation. This shows the company’s new worth, affecting ownership and fundraising plans.

Deriving Pre-Money Valuation from Funding Details

Before any money is exchanged, a company’s pre-money valuation is set. This valuation is key as it decides the equity investors get and the stakes of current shareholders. It considers market conditions, company performance, and trends.

Entrepreneurs must understand how pre-money valuation affects negotiations. A higher valuation can mean more ownership for current shareholders. It also shapes the company’s market position and future investor appeal.

Grasping cash raised and post-money valuation helps entrepreneurs manage financing. By mastering these metrics, businesses can plan equity distribution and secure funding that meets their goals.

The Investor Perspective: Importance of Cash Raised and Post Money

In the world of startup investment, knowing how to value money is key. Investors look closely at cash raised and post money to see if a company will do well. They also use post-money valuation to make their investment decisions.

Going from pre-money to post-money valuation is a big part of venture capital. It affects how much money is invested and what the company might grow to be worth. This helps investors know if their money will grow and return well.

Investor Considerations During Funding Rounds

During funding rounds, investors do a lot of checking. They look at post money valuation and cash raised to make sure the money is worth it. They want to make sure their money will give them the right amount of control in the company.

They also think about the market, how fast the company can grow, and if it’s innovative. This helps them decide if investing is a good idea.

The Impact of Valuation on Ownership and Returns

Investors and founders need to understand how new money changes ownership. Knowing this helps them see how much control investors will have.

Looking at cash raised and post money is not just for fun. It shows how much equity investors get and how much control they have. This affects how well the company will do and how much money investors will make.

In short, knowing how to value money is crucial for startups. It helps investors decide if a startup is worth their money. This knowledge helps avoid risks and make money grow.

Examining Case Studies: Real-World Valuation Scenarios

The significance of cash raised in fundraising is tied to the complex world of valuation. This is key for a company’s life, from starting up to selling out. Many startups have grown thanks to successful fundraising.

Looking at how valuations change can guide big decisions like going public or being bought. This shows that the cash raised meaning is more than just a number. It’s a guide for future money plans and how to pay employees. Accurate valuations help keep talent and stay ahead of the competition.

- Startup Growth: The size of the market and how far along a product is affect valuations. Products ready for market and big markets get higher valuations, making investors more confident.

- Management Teams: Teams with experience make investors trust a company more. This means higher valuations and better chances of getting funded.

Real-world examples show how important negotiation over valuation is. A high valuation gives entrepreneurs more power in talks, which is key for good funding deals. For more on this, check out this in-depth look at pre-money and post-money valuations

As markets change and new ways to invest come up, especially in private markets, examples of valuation are crucial. They help create strong financial and strategic plans. This helps manage risks now and plan for the future, which is vital for growth and staying strong.

“Valuations from real-world examples are a key tool for detailed financial planning and risk analysis in private markets.”

Understanding the significance of cash raised in fundraising through these examples helps startups and investors. It lets them make better decisions, leading to financial success and growth.

Common Pitfalls: Understanding the Limitations of Valuation Models

When evaluating startups, professionals often face big challenges in comparing startups. This is because startups have different business models and are at various stages of growth. It’s key to know these challenges to use valuation models right.

The limitations of post-money valuations often lead to a wrong view of a startup’s future. These valuations look at the cash put in during funding rounds. But they don’t fully consider the startup’s future performance or market changes. This narrow view can make a company’s real value and future earnings seem off.

Challenges with Pre-Money Valuations

Pre-money valuations have biases that can change with the market or the reputation of the founders. These valuations are not always fair. They can be swayed by things that don’t really show the business’s true worth.

Overcoming Misconceptions of Post-Money Valuations

To clear up these misconceptions, we need a careful method. Using different valuation methods, like Discounted Cash Flow (DCF) and Comparable Company Analysis (CCA), helps. These methods compare the startup’s financial plans with real market data.

- DCF models look at the startup’s value based on its future cash flows.

- CCA compares the startup to similar public companies, giving a market-based view.

To really get past the limitations of post-money valuations, we should mix these methods. This gives a clear, detailed valuation that looks at both numbers and market conditions. Working with experts like Eton can make sure these valuations are solid and fit each startup’s unique situation.

To make startup valuations fair and accurate, we must tackle the challenges in comparing startups. We need to standardize overcoming valuation models to show both market trends and the startup’s unique strengths.

In summary, knowing the limitations of post-money valuations and the challenges in comparing startups shows we need flexible and complete valuation methods. These methods are key to really understanding a startup’s value.

Navigating Complexities: Legal and Strategic Implications

Understanding venture capital needs a strong grasp of the legal framework in investment valuations and its strategic sides. This section will explore key laws and strategies that shape financial choices in venture capital.

The Legal Framework of Investment Valuations

Following securities laws is key to making deals that protect investors and help businesses grow. With finance being closely watched, experts must keep up with changes in laws like Regulation A+ and Regulation Crowdfunding. These rules affect how much money can be raised and the reporting needed, impacting valuations and business growth.

Strategic Planning Based on Valuation Insights

Knowing the strategic implications of cash raised vs post money is crucial for success. Venture capital planning mixes finance with growth strategies. Companies use models to predict future cash flows and growth, guiding their strategies with pre-money and post-money valuations.

It’s wise to work closely with financial and legal advisors who know the market and laws well. They offer insights that help strengthen a company’s value with strategic planning.

In summary, mastering venture capital needs a mix of legal knowledge and strategic planning. With the right advice, companies can improve their investment appeal while following legal rules, ensuring growth and good returns.

Conclusion

In the world of venture capital and startup growth, knowing the difference between cash raised vs post money is key. More than half of all deals depend on pre-money valuations. This shows how crucial it is to understand financial terminology in fundraising.

Learning these terms helps startups navigate the funding world. It’s not just about knowing the terms; it’s about using that knowledge to succeed.

For example, a company might raise $1 million at a $7 million post-money valuation. This shows how equity is split and how investments can succeed. Knowing the benefits of knowing cash raised vs post money is vital for clear talks.

Startups like Shuttlers get big funding, and firms like Nubia Capital invest in new businesses. This shows how important good post-money valuation strategies are. If a company is worth $2 million before funding and raises $500,000, its value goes up to $2.5 million.

So, entrepreneurs and investors need to understand how to figure out post-money valuation. This skill is vital from early funding to Series D events. Knowing the value of a company helps investors make smart choices and grow their investments.